Sure, a person will want in buy to make repeating build up to the particular account, nevertheless not immediate build up. Cash advance applications enable a person to get a small advance upon your own next salary, much like a payday financial loan, without too much fees. On The Other Hand, cash advance applications frequently have got charges, thus examine programs before getting a great advance in buy to decide your current greatest option. It’s also crucial to be in a position to take note of which a few cash advance apps won’t identify Cash Software being a verifiable lender bank account, also if your current paycheck is straight placed. Rather, you’ll have got to look for a even more conventional way to be in a position to show your optimistic lender account historical past. Cleo provides a 24-hour cooling away from time period between loans, which implies a person could get a new advance simply 1 day time following paying away your current previous advance.

Credit Rating

But if you perform land a career down the collection, possibilities are you’ll increase your own cash advance limit which usually could ascend upward to end upward being in a position to $250. The Majority Of programs like Empower impose strict membership and enrollment specifications, but Encourage offers fewer certification, making it easier with respect to persons, freelancers, plus gig workers to borrow speedy funds. EarnIn’s Stability Safeguard automatically advances $100 when your lender equilibrium goes under a particular reduce. An Individual may likewise keep track of your current VantageScore for free with the integrated credit score supervising services. MarketWatch Manuals may obtain settlement through firms that will appear on this particular web page.

Leading Money Advance Apps Along With Zero Credit Rating Check Inside 2025

We try in order to supply up dated information, yet create no warranties regarding the accuracy regarding our info. FinanceBuzz would not supply credit rating credit cards or virtually any other monetary goods. Maybe the particular greatest alternate to become in a position to a relatively tiny cash advance will be briefly increasing your income.

- Immediate BNPL loans generally don’t possess interest, but an individual’ll want in order to pay away typically the financial loan more than four or half a dozen installments above a few months to end up being able to avoid late fees.

- Funds advance applications may possibly automatically take away money through your own financial institution accounts any time repayment is usually due.

- If a person have a Vola card, the funds is acknowledged to become in a position to your current cards immediately.

- You can employ Albert Instant as de facto overdraft security too.

- Along With most lenders, an individual may acquire your financial loan by simply typically the subsequent business day, in add-on to sometimes even faster.

Funds advance programs give you accessibility to funds before your own payday, offering a more inexpensive alternate in purchase to standard bank overdraft services, which often often arrive together with large charges. Instead of depending about high-interest loans, these types of applications use non-reflex suggestions or flat charges as a income resource. The subsequent time an individual need a great advance, you don’t have got to be capable to be concerned concerning opening a new financial institution account or finding a approach to become able to get cash or overdraft coverage. As An Alternative, you can use your own Money Software and a number of funds advance applications in buy to make finishes fulfill.

#9 – Current: Two Techniques In Purchase To Accessibility Extra Cash!

Actually though presently there aren’t any late charges, this may possibly lead to a lowered borrowing reduce. As a person build trust by indicates of on-time repayments, a person could watch your own borrowing roof rise. Plaid will be built in to most of these sorts of programs, in inclusion to works like a secure bridge in between your current financial institution in inclusion to the particular funds advance application. Through Plaid, these types of apps can view your banking data, guaranteeing a fast verification process.

- Dave offers money improvements of upward in purchase to $500 (though extremely number of customers qualify with regard to quantities above $100), in add-on to has a month to month subscription charge regarding $1.00.

- Consider associated with them being a economic safety web, not really a regular component associated with your month to month budget.

- Current will be a mobile banking system of which provides its own banking services.

These can become identified on the particular Funds case upon your Cash Software home display screen. Getting At funds early on will be a slippery slope, plus I don’t inspire it. However, a few regarding the particular over alternatives appear relatively low-cost in case you must use these people in a one-off bind. Cash improvements are free plus possess zero charges, but an individual may wait upwards in buy to five business times. In Case you want quick money, an individual could pick Turbo delivery with consider to a fee.

- The Particular Current Visa® guaranteed demand cards is usually given by simply Mix River Lender pursuant to this license through Visa Oughout.S.A. Incorporation. plus may possibly be utilized just about everywhere Visa for australia credit cards usually are approved.

- Dork allows an individual to become capable to borrow up to $500 any time you meet membership requirements.

- While EarnIn has a few associated with typically the greatest advances amongst money advance apps, not really all customers are usually qualified with respect to the greatest borrowing restrictions.

- Occasionally, the particular $100 or $250 reduce about payday advance apps isn’t enough to include all your own costs.

- Retain in thoughts that every disbursement is usually limited in buy to $100 at a time, irrespective of your total Instacash borrowing limit.

Getting a money advance can conserve an individual coming from a lot of difficulty in inclusion to costs when you don’t have got a great unexpected emergency fund to touch into. If your unexpected emergency is a one-time thing plus the particular quantity will be small, take into account requesting a person close in buy to an individual in case an individual may borrow the particular money. Become positive a person established obvious terms regarding repayment therefore presently there usually are no misunderstandings or hard emotions.

Fees And Details

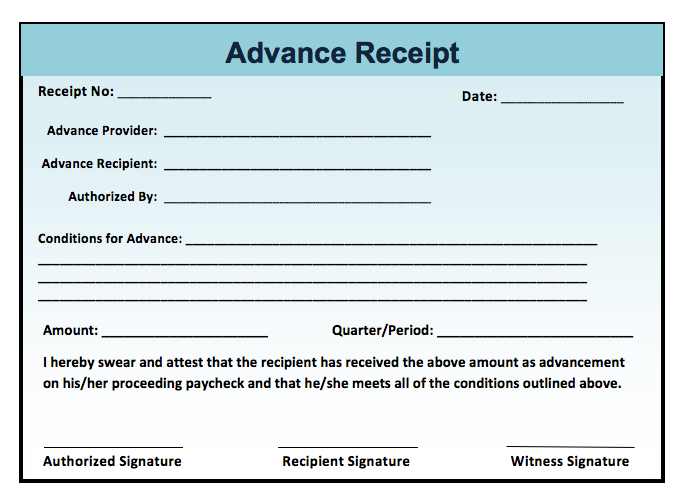

Whilst right right now there is usually no APR on funds advances, a person must pay a $1 month-to-month administrative fee whether or not an individual get improvements. Money advancements bring costs plus charges just like borrow cash app any sort of additional loan or credit credit card. Cash Software costs a 5% purchase charge for every cash advance but would not demand interest or late charges. This indicates a $100 funds advance will bear a $5 fee, reducing the particular internet quantity received to be in a position to $95. A money advance is a purchase that permits you to obtain funds from a lender within advance associated with upcoming newly arriving money.